Blockchain Ownership, Fractionalized Investment & More

Featured Properties

FONTAINEBLEAU TRESOR TOWER, Pent House North

Concord Mall

FONTAINEBLEAU TRESOR TOWER, Pent House South

How it works?

1. Tokenize the property

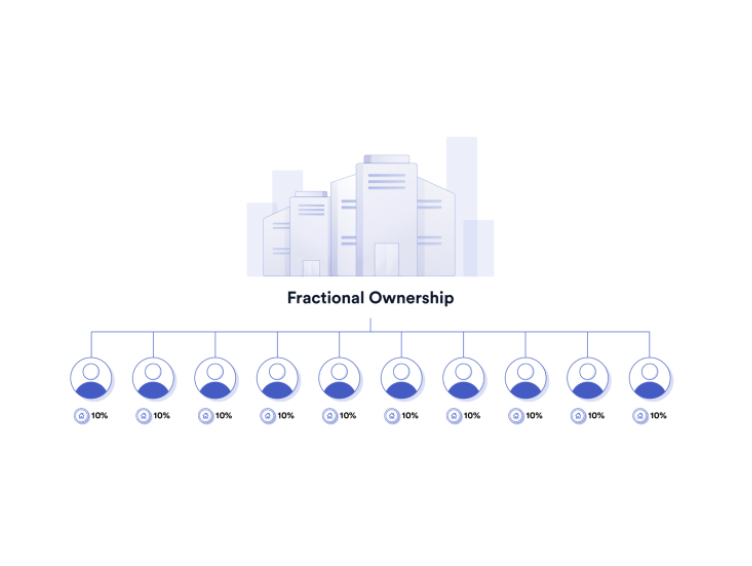

Tokenization is the process of creating digital securities, or tokens, to represent total, or fractional ownership of an asset. Similar to crowdfunding, tokenization improves capital formation by allowing smaller investors to pool capital to invest in larger projects - and enables sponsors to raise capital from a larger investor pool.

2. Create Tokenized Delaware LLC

Real estate can’t directly be tokenized, but legal entities can. Each property is owned by company (an LLC). Each company is tokenized as a unique set of Phygits and made available for purchase.

3. Deed property to the tokenized LLC

The purchase and sale transaction and paperwork between seller and the LLC/Inc. is conducted by experienced attorneys upon whom we comfortably rely on. Included in the paperwork is the transfer of deed and a filing in the appropriate jurisdiction is made. The paperwork is then filed with an independent escrow agent which holds the papers on behalf of the LLC/Inc.. Strict laws exist in the US governing escrow arrangements which we proudly abide by.

Why tokenize property?

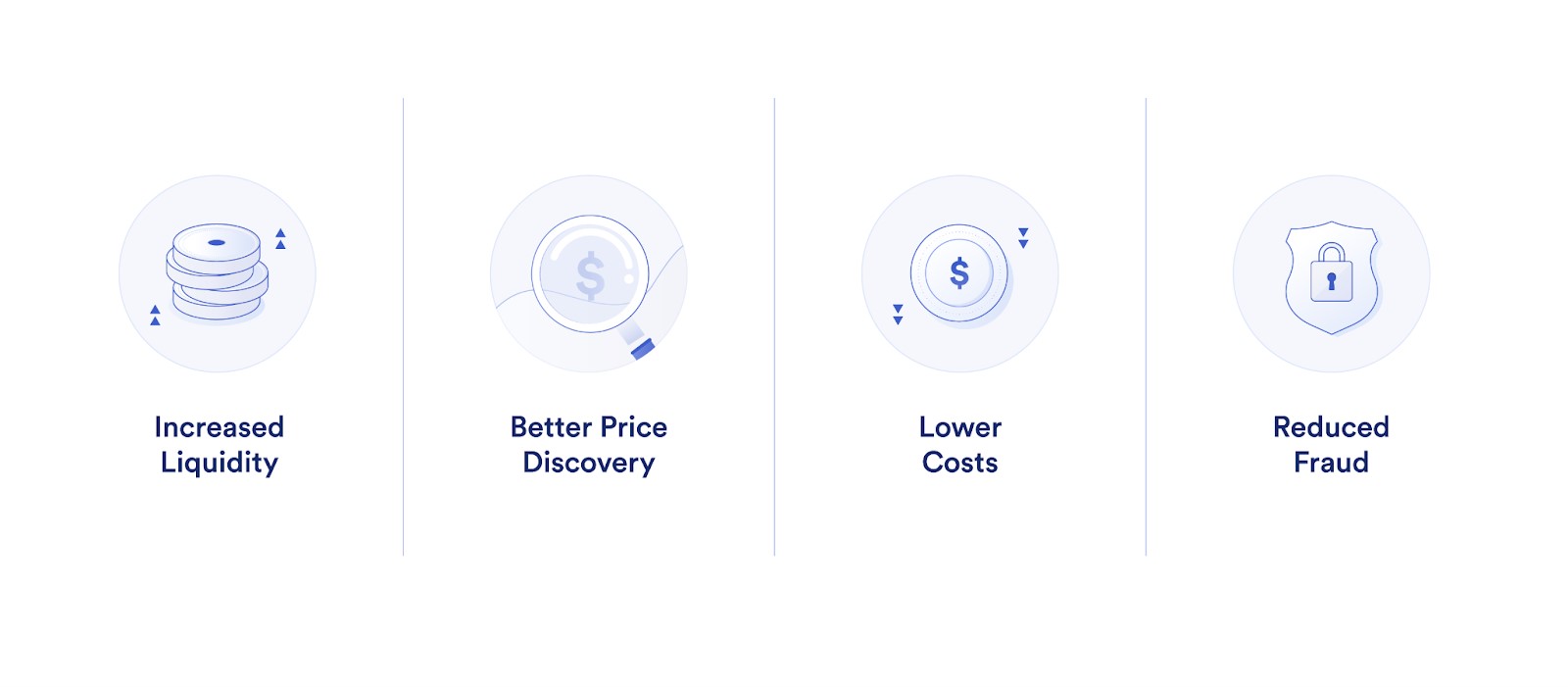

Tokenized assets on the blockchain provide for a more tangible and liquid representation of ownership interest in property through digital securitization on a blockchain.

Tokenizations have potential to provide a variety of benefits, including granting investors access to markets that are otherwise inaccessible or costly to enter. For example, real estate tokenizations might allow for investment in a fraction of the underlying asset, with investors able to purchase shares in specific commercial buildings or residential investments, as opposed to real estate investment trusts (REITs) where investors own shares of a portfolio of real estate investments.

-Investors purchase digital shares, representing their ownership

-Digital shares are distributed to investors, with the management, distribution, payments, and reporting handled by Phygits.

-Investors benefit from the liquidity of their digital securities, as well as access to borrowing and payments tools.

Tokenizations have potential to provide a variety of benefits, including granting investors access to markets that are otherwise inaccessible or costly to enter. For example, real estate tokenizations might allow for investment in a fraction of the underlying asset, with investors able to purchase shares in specific commercial buildings or residential investments, as opposed to real estate investment trusts (REITs) where investors own shares of a portfolio of real estate investments.

-Investors purchase digital shares, representing their ownership

-Digital shares are distributed to investors, with the management, distribution, payments, and reporting handled by Phygits.

-Investors benefit from the liquidity of their digital securities, as well as access to borrowing and payments tools.

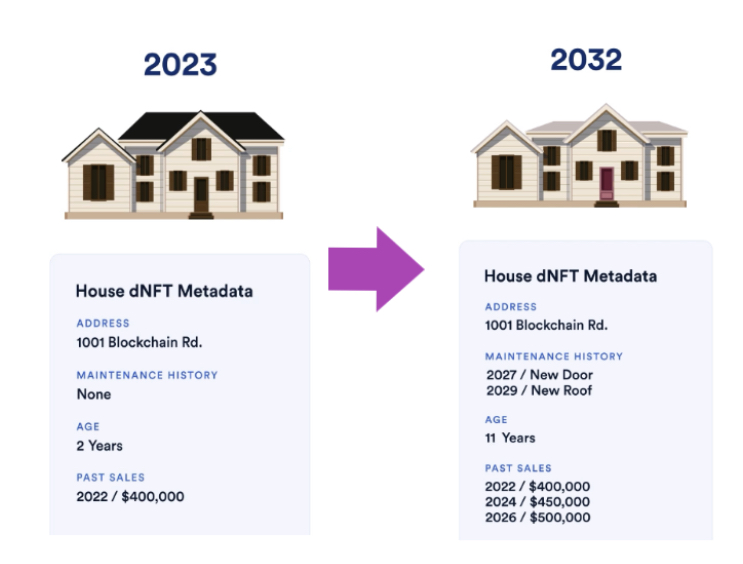

(Tokenized property Blockchain history illustration)

“Tokenization is ideal for owners of a single asset or a small portfolio of assets, due to the significant reduction of time and cost in offering investors the right to participate in fractional ownership and subsequent secondary trading.” - KPMG

"Tokenizations have potential to provide a variety of benefits, including granting investors access to markets that are otherwise inaccessible or costly to enter. For example, real estate tokenizations might allow for investment in a fraction of the underlying asset, with investors able to purchase shares in specific commercial buildings or residential investments, as opposed to real estate investment trusts (REITs) where investors own shares of a portfolio of real estate investments." - US Federal Reserve

"Tokenizations have potential to provide a variety of benefits, including granting investors access to markets that are otherwise inaccessible or costly to enter. For example, real estate tokenizations might allow for investment in a fraction of the underlying asset, with investors able to purchase shares in specific commercial buildings or residential investments, as opposed to real estate investment trusts (REITs) where investors own shares of a portfolio of real estate investments." - US Federal Reserve